The rise of crypto venture capital firms has transformed the way blockchain startups launch and thrive. In 2025, they have become the backbone of Web3 innovation, fueling everything from DeFi protocols to decentralized infrastructure and gaming ecosystems.

As a founder, knowing the top crypto VCs means understanding who can truly accelerate your project. For investors, it serves as a window into the most influential crypto players preparing to shape the future of digital assets and decentralized economies.

However, finding a Venture Capital firm that aligns with your project goals and ethos is extremely difficult. Getting their attention after finding one is even more laborious. For this purpose, we have crafted a list of the 15 best VC firms with their strengths and requirements for you to choose from.

How Crypto Venture Capital Firms are Important for Businesses and Startups

Crypto venture capital (VC) firms are the lifeblood of innovation in the blockchain ecosystem. They fuel growth through capital, credibility, and connections. VCs provide early-stage funding to help startups build products, hire talent, and scale operations. This financial backing is especially crucial in the cryptocurrency world, where infrastructure and regulatory hurdles necessitate significant upfront investment.

VC endorsement often leads to media coverage, community trust, and easier access to future funding rounds. They also connect startups with key players, including developers, advisors, legal experts, and marketing teams.

VCs actively seek out disruptive ideas in DeFi, Web3, Layer 2 scaling, and privacy tech. They also help refine product-market fit and iterate on MVPs through mentorship and feedback. Crypto VCs guide startups in designing sustainable token models by balancing supply, demand, incentives, and governance.

VCs bring legal expertise to help startups comply with evolving global regulations, such as KYC/AML and securities laws. VC-backed projects are more likely to be listed on top cryptocurrency exchanges, such as Coinbase or Binance. They often have direct relationships with exchange teams to facilitate a smooth listing process.

VCs facilitate cross-border partnerships, integrations, and go-to-market strategies. They also help startups expand into new regions with localized support and strategic alliances.

How Venture Capital Funding Works in Crypto & Web3

Venture capital (VC) funding in crypto and Web3 is similar to traditional tech startups, but with some unique twists involving tokens, decentralized governance, and liquidity strategies.

- Founders pitch their ideas to VCs, often accompanied by a white paper, a tokenomics model, and a roadmap. VCs then assess the team’s credibility, technical vision, and market potential, particularly in emerging areas such as DeFi, NFTs, or Layer 2 scaling.

- VCs then conduct their due diligence by thoroughly examining the tech architecture, tokenomics, legal structure, and community traction.

- Unlike traditional startups, cryptocurrency deals often involve token allocations rather than equity. VCs negotiate token prices, vesting schedules, governance rights, board seats, and advisory roles.

- Once the negotiations are done, VCs help with exchange listings, partnerships, marketing, community growth, and regulatory guidance.

VC funding in crypto and Web3 has unique features that set it apart from traditional fundraising models.

- Token Allocations: VCs receive tokens instead of equity, often with vesting schedules.

- Governance Rights: VCs may gain voting power in DAOs or protocol decisions.

- Liquidity Timelines: Tokens can become liquid faster than equity, sometimes within months.

- Airdrops and Incentives: VCs help design incentive programs to bootstrap user adoption.

- Regulatory Complexity: Token sales must navigate complex securities laws and global compliance requirements.

There are generally different funding stages in crypto/Web3, ranging from pre-seed to Series C.

| Stage | Purpose |

| Pre-Seed | Idea-stage that is often bootstrapped or angel-funded ($50K–$500K) |

| Seed | MVP development and early community building ($500K–$2M) |

| Series A | Scaling product, hiring, and token launch prep ($2M–$15M) |

| Series B | Market expansion, exchange listings, and partnerships ($15M–$50M) |

| Series C | Global growth, regulatory scaling, and acquisitions ($50M+) |

Top Crypto Venture Capital Firms in 2025

In 2025, the crypto venture capital landscape is thriving, with several firms leading the charge in funding blockchain innovation, decentralized finance (DeFi), Web3 infrastructure, and tokenized assets. We have shortlisted the 15 best crypto VC firms that are help shape the Web3 as we know it right now.

1. Andreessen Horowitz (a16z)

Andreessen Horowitz, commonly known as a16z, is a Silicon Valley-based venture capital firm founded in 2009 by Marc Andreessen and Ben Horowitz. It launched its dedicated crypto fund in 2018, which signaled its deep commitment to blockchain and Web3 technologies. Today, a16z is a powerhouse in the crypto VC world, known for bold bets, hands-on support, and regulatory advocacy.

a16z targets high-impact areas in crypto and Web3, including:

- DeFi protocols

- Layer 1 and Layer 2 blockchains

- AI-powered crypto agents

- Decentralized identity and proof-of-personhood

- Tokenized real-world assets (RWAs)

- DAO infrastructure and governance tooling

Andreessen Horowitz manages over $7.6 billion in crypto and Web3-focused funds as of 2025. Their fourth crypto fund, launched in 2022, raised $4.5 billion, making it one of the largest dedicated crypto funds globally.

Their notable investments include.

- Ethereum

- Uniswap

- OpenSea

- Dapper Labs

- Optimism

- Arweave

- Coinbase

Headquartered in Menlo Park, California, a16z is most active in North America, particularly in the U.S. They are increasingly expanding into global markets, supporting projects with international reach and cross-border token strategies.

2. Pantera Capital

Founded in 2003 by Dan Morehead, Pantera Capital was originally a traditional hedge fund before pivoting to focus exclusively on blockchain and digital assets in 2013, making it one of the earliest institutional investors in crypto. Pantera Capital is known for its deep conviction in blockchain’s long-term potential and its ability to identify transformative technologies early.

Pantera invests across the full spectrum of crypto innovation, with emphasis on:

- Blockchain infrastructure

- DeFi protocols

- Web3 applications

- Tokenized financial assets

- Privacy and scalability solutions

- Cross-chain interoperability

As of 2025, Pantera Capital manages over $4.7 billion in blockchain-focused assets, and their notable investments include.

- 0x Protocol (decentralized exchange infrastructure)

- Brave (privacy-focused browser with BAT token)

- Bitso (Latin America’s leading crypto exchange)

- Circle (issuer of USDC stablecoin)

- StarkWare (zero-knowledge scaling solutions)

- Ankr (Web3 infrastructure and staking)

Headquartered in Menlo Park, California, Pantera is most active in North America. They also maintain a strong presence in Latin America, Asia, and Europe, often investing in regional exchanges, payment platforms, and infrastructure providers.

3. Paradigm

Paradigm is a crypto-native investment firm founded in 2018 by Fred Ehrsam (co-founder of Coinbase) and Matt Huang (former Sequoia Capital partner). The firm is recognized for its in-depth technical expertise, open-source contributions, and hands-on involvement with early-stage cryptocurrency protocols.

Paradigm specializes in:

- Protocol-level innovation (Layer 1s, Layer 2s)

- Zero-knowledge cryptography

- Decentralized finance (DeFi)

- DAO infrastructure and governance

- On-chain games and social networks

- Open-source tooling and developer platforms

Paradigm reportedly manages over $2.5 billion in crypto assets as of 2025, and their notable investments include.

- Uniswap (decentralized exchange)

- Optimism (Layer 2 scaling)

- dYdX (decentralized derivatives)

- Blur (NFT marketplace)

- EigenLayer (restaking protocol)

- Farcaster (decentralized social protocol)

Headquartered in San Francisco, California, Paradigm is most active in North America. However, they maintain a global outlook, investing in teams across Europe, Asia, and Latin America.

4. Animoca Brands

Animoca Brands is a Hong Kong-based company founded in 2014, originally focused on mobile gaming. It pivoted early into blockchain and NFTs, becoming a dominant force in the Web3 gaming and metaverse space. Animoca Brands combines venture investing with direct product development, owning and operating a vast portfolio of decentralized games and IPs.

Animoca Brands specializes in:

- Blockchain gaming and play-to-earn (P2E) models

- NFT infrastructure and marketplaces

- Digital property rights and metaverse assets

- Tokenized in-game economies

- Educational platforms using gamification

As of 2025, Animoca Brands has raised over $880 million across 22 funding rounds, including seed, early-stage, late-stage, and post-IPO rounds. Their largest round was a $360 million Series C in January 2022, which valued the company at $5 billion. Their notable investments include.

- The Sandbox (metaverse platform)

- Axie Infinity (play-to-earn pioneer)

- OpenSea (NFT marketplace)

- Dapper Labs (NBA Top Shot)

- Polygon (scalable blockchain infrastructure)

- Yuga Labs (creator of Bored Ape Yacht Club)

Headquartered in Hong Kong, Animoca Brands is highly active across Asia, especially in South Korea, Japan, and Southeast Asia. However, they also maintain strong investment and partnership networks in North America, Europe, and Australia.

5. Polychain Capital

Polychain Capital was founded in 2016 by Olaf Carlson-Wee, the first employee at Coinbase. The firm quickly became one of the earliest and most influential crypto-native venture capital firms, with a strong emphasis on protocol development, governance systems, and long-term network value.

Polychain Capital is known for backing projects that build the foundational layers of Web3, including:

- Layer 1 and Layer 2 blockchains

- Decentralized governance and DAOs

- Interoperability and cross-chain infrastructure

- Zero-knowledge cryptography

- Privacy-preserving technologies

- Web3-native financial primitives

As of 2025, Polychain Capital manages over $3 billion in crypto assets, and their notable investments include.

- Polkadot (interoperable Layer 1)

- Dfinity / Internet Computer (decentralized cloud computing)

- Tezos (self-amending blockchain)

- Avalanche (high-performance Layer 1)

- Filecoin (decentralized storage)

- NEAR Protocol (developer-friendly Layer 1)

- Gauntlet (on-chain risk modeling)

Headquartered in San Francisco, California, Polychain is most active in North America. They also maintain a global investment footprint, with notable activity in Europe, Asia, and Latin America.

6. Sequoia Capital

Sequoia Capital was founded in 1972 and is headquartered in Menlo Park, California. Known for backing legendary companies like Apple, Google, and Airbnb, Sequoia Capital has expanded its focus to include crypto and blockchain technologies after recognizing their potential to redefine finance and the internet itself.

While Sequoia Capital remains a generalist VC, its crypto investments target:

- Web3 infrastructure

- DeFi protocols

- Blockchain-based identity and data ownership

- Tokenized networks and marketplaces

- Developer tooling and smart contract platforms

Sequoia manages over $85 billion globally across all sectors. In 2022, they launched a $600 million crypto-focused fund, signaling a dedicated push into Web3. Their notable investments include.

- Polygon (Ethereum scaling)

- FTX (before its collapse)

- Fireblocks (digital asset custody)

- LayerZero (cross-chain messaging)

- Mysten Labs (creator of the Sui blockchain)

- Citadel Securities (crypto market infrastructure)

Sequoia is active in North America, India, Southeast Asia, and China. However, their crypto investments span global teams, with a strong presence in Singapore, Bangalore, and San Francisco.

7. Digital Currency Group (DCG)

Digital Currency Group (DCG) was founded in 2015 by Barry Silbert and is headquartered in Stamford, Connecticut. DCG is a venture capital firm and holding company focused exclusively on the digital asset space. Unlike traditional VCs, DCG owns and invests in companies that span the entire crypto stack.

DCG’s investment strategy centers on:

- Institutional infrastructure

- Blockchain analytics and forensics

- Tokenized financial products

- Media and education in crypto

- Decentralized finance (DeFi) and Web3 platforms

While exact AUM figures fluctuate, DCG’s portfolio and subsidiaries represent multi-billion-dollar holdings. Their most prominent subsidiary, Grayscale Investments, manages over $30 billion in crypto assets through publicly traded trusts. Their notable investments include.

- Grayscale Investments (crypto asset management)

- Foundry (Bitcoin mining and staking infrastructure)

- Luno (global crypto exchange and wallet)

- TradeBlock (institutional trading tools)

- Coinbase (exchange)

- Chainalysis (blockchain analytics)

- Circle (issuer of USDC)

- Ledger (hardware wallets)

- Brave (privacy browser with BAT token)

- Decentraland (metaverse platform)

DCG is most active in North America, especially the United States. However, through Luno, they maintain a strong presence in Africa, Southeast Asia, and Europe.

8. Coinbase Ventures

Coinbase Ventures was launched in 2018 by Coinbase, the publicly traded U.S.-based crypto exchange. Unlike traditional VC firms, Coinbase Ventures operates as a strategic investor. It backs early-stage startups that align with Coinbase’s mission to create an open financial system for the world.

Coinbase Ventures invests in:

- Crypto infrastructure

- DeFi protocols

- Web3 applications

- Layer 1 and Layer 2 blockchains

- Regulatory and compliance tech

- Tokenized finance and real-world assets (RWAs)

While Coinbase Ventures does not operate a traditional fund with disclosed AUM, it has made over 400 investments since its inception. Its notable investments include.

- Arweave (decentralized storage)

- Messari (crypto data and research)

- Magic Eden (NFT marketplace)

- Goldfinch (DeFi credit protocol)

- Zapper (DeFi dashboard)

- Dune Analytics (on-chain data analytics)

- Blockdaemon (staking and node infrastructure)

Headquartered in San Francisco, California, Coinbase Ventures is most active in North America. However, it also maintains a global investment footprint, supporting teams in Europe, Asia, Africa, and Latin America.

9. Fenbushi Capital

Fenbushi Capital was founded in 2015 by Bo Shen and is headquartered in Shanghai, China. It was one of the first venture capital firms in the world to focus exclusively on blockchain technology.

Fenbushi Capital invests in:

- Blockchain infrastructure

- Decentralized finance (DeFi)

- Web3 applications

- Cross-chain interoperability

- Privacy and identity solutions

- Tokenized economies and DAO governance

While exact AUM figures are not publicly disclosed, Fenbushi Capital has participated in over 150 investments across multiple funds and strategic vehicles. Their notable investments include.

- Ethereum (early supporter)

- VeChain (enterprise blockchain)

- Zcash (privacy-focused cryptocurrency)

- Cosmos (interoperable blockchain ecosystem)

- IPFS/Filecoin (decentralized storage)

- Polkadot (multi-chain protocol)

- Chainlink (decentralized oracle network)

Headquartered in Shanghai, Fenbushi is most active in China, Hong Kong, and Southeast Asia. However, they also maintain a global investment footprint, with strategic partnerships in North America, Europe, and Africa.

10. Multicoin Capital

Multicoin Capital was founded in 2017 by Kyle Samani and Tushar Jain, and is headquartered in Austin, Texas. The firm quickly gained recognition for its deep research, strong convictions, and early investments in high-performance blockchain ecosystems.

Multicoin Capital invests in:

- Smart contract platforms and Layer 1 blockchains

- Modular blockchain architecture

- Tokenized data networks

- Web3 infrastructure and middleware

- Decentralized wireless (DeWi) and physical infrastructure networks

- Crypto-native consumer apps and marketplaces

As of 2025, Multicoin Capital manages over $1.5 billion in crypto assets across venture and hedge fund vehicles, with notable investments including.

- Solana (high-speed Layer 1 blockchain)

- Helium (decentralized wireless network)

- Arweave (permanent decentralized storage)

- The Graph (blockchain indexing protocol)

- Render Network (decentralized GPU rendering)

- Syndica (Solana infrastructure tooling)

Headquartered in Austin, Texas, Multicoin is most active in North America. However, they also maintain a global investment footprint, supporting teams in Europe, Asia, and Latin America.

11. Outlier Ventures

Outlier Ventures was founded in 2014 by Jamie Burke and is headquartered in London, UK. The firm began as a blockchain-focused VC and evolved into one of the most active Web3 accelerators globally.

Outlier Ventures specializes in:

- Web3 infrastructure and middleware

- Open metaverse platforms

- Decentralized identity and data ownership

- Tokenized networks and DAOs

- NFTs, gaming, and creator economies

- Privacy-preserving and zero-knowledge technologies

While exact AUM figures are not publicly disclosed, Outlier Ventures has supported over 250 startups through its accelerator programs. Their flagship accelerator, Base Camp, offers funding, mentorship, and token design support to early-stage Web3 founders. Their notable investments and alums include.

- Fetch.ai (autonomous economic agents)

- Boson Protocol (decentralized commerce)

- Aavegotchi (NFT gaming)

- Agoric (smart contract platform)

- Crucible (digital identity for the metaverse)

- Ocean Protocol (decentralized data exchange)

Headquartered in London, Outlier Ventures is highly active across Europe, North America, and Asia. Their accelerator programs attract founders from over 50 countries, making them one of the most globally inclusive Web3 platforms.

12. Hashed

Hashed was founded in 2017 by Simon Seojoon Kim and is headquartered in Seoul, South Korea. It is one of Asia’s most influential blockchain investment firms, known for its deep involvement in Web3 infrastructure, gaming, and decentralized finance.

Hashed invests in:

- Layer 1 and Layer 2 blockchains

- Web3 gaming and metaverse platforms

- DeFi protocols and staking infrastructure

- Decentralized identity and data sovereignty

- Cross-chain interoperability

- Tokenized economies and DAO tooling

Hashed manages over $1 billion in crypto assets across multiple funds. In 2021, they launched Hashed Venture Fund II with $200 million, aimed at supporting early-stage Web3 startups globally. Their notable investments include.

- Terra (before its collapse)

- Axie Infinity (play-to-earn gaming)

- Klaytn (enterprise blockchain by Kakao)

- The Sandbox (metaverse platform)

- dYdX (decentralized derivatives)

- Chai (Korean fintech using blockchain rails)

- Aptos (Layer 1 blockchain)

Headquartered in Seoul, Hashed is most active in South Korea, Japan, and Southeast Asia. They also maintain a strong presence in North America, with offices in San Francisco and Singapore.

13. Lightspeed Venture Partners

Lightspeed Venture Partners was founded in 2000 and is headquartered in Menlo Park, California. Known for backing iconic tech companies such as Snap, Affirm, and Nutanix, Lightspeed has expanded its focus to include blockchain, cryptocurrency, and Web3 technologies.

Lightspeed’s crypto investments target:

- Web3 infrastructure and developer tooling

- DeFi protocols and financial primitives

- Blockchain-based data and identity platforms

- Tokenized gaming and creator economies

- Cross-chain interoperability and Layer 2 scaling

Lightspeed manages over $25 billion in assets across all sectors. In 2023, Lightspeed Faction announced a $285 million crypto venture fund, focused on early-stage token and equity deals. Their notable investments include.

- Matter Labs (developer of zkSync)

- Crossmint (NFT infrastructure)

- Argus (on-chain compliance tooling)

- Magic (Web3 authentication)

- Stacks (Bitcoin Layer 2 smart contracts)

- Blockade Games (Web3 gaming)

Headquartered in Silicon Valley, Lightspeed is active across North America, Europe, India, and Israel. Their crypto investments span global teams, with a strong presence in developer hubs like Berlin, Tel Aviv, and Bangalore.

14. Draper Associates

Founded by Tim Draper in 1985, Draper Associates is a Silicon Valley-based venture capital firm known for early investments in transformative technologies. The firm has backed iconic companies like Tesla, Skype, Hotmail, and Baidu, and was one of the earliest institutional investors in Bitcoin.

Draper Associates invests in:

- Blockchain infrastructure

- Decentralized finance (DeFi)

- Web3 applications and DAOs

- Tokenized identity and data platforms

- Cross-border crypto solutions

- AI and blockchain convergence

While exact AUM figures are not publicly disclosed, Draper Associates manages hundreds of millions of dollars in venture capital. Their notable investments include.

- Bitcoin (early personal investment by Tim Draper)

- Coinbase (crypto exchange)

- Ledger (hardware wallets)

- Tezos (self-amending blockchain)

- Bancor (automated market maker protocol)

Draper Associates is headquartered in Menlo Park, California, and is most active in North America.

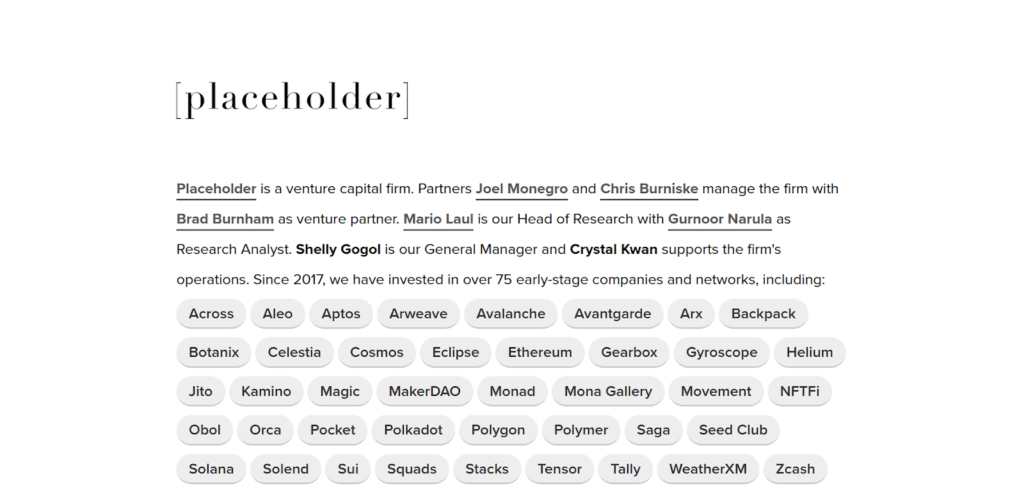

15. Placeholder VC

Placeholder VC was founded in 2017 by Chris Burniske and Joel Monegro. Based in New York City, Placeholder is recognized for its rigorous intellectual approach, long-term commitment, and minimalist investment strategy.

Placeholder VC specializes in:

- Tokenized protocols and governance systems

- Decentralized data and identity

- Web3 infrastructure and developer tooling

- DAOs and network-native organizations

- Privacy-preserving technologies

- Crypto-economic design and token engineering

Placeholder VC manages hundreds of millions of dollars in crypto assets across multiple funds. They maintain a concentrated portfolio, investing in a small number of high-conviction projects rather than spreading capital widely. Their notable investment include.

- NEAR Protocol (developer-friendly Layer 1)

- Arweave (permanent decentralized storage)

- The Graph (blockchain indexing protocol)

- Urbit (personal server infrastructure)

- Zora (NFT protocol and marketplace)

- Variant Fund (co-investment partner in Web3 consumer apps)

Headquartered in New York, Placeholder is most active in North America. They also support globally distributed teams, especially those building open-source protocols with decentralized communities.

How to Choose the Right VC Fund for Your Project

Here is a practical and founder-friendly checklist to help you choose the right VC fund for your crypto or Web3 project.

- Stage Fit: Check whether the fund invests at your project’s current stage. These stages include Pre-Seed/Seed (ideation, MVP, early traction) and Series A/B+ (scaling, product-market fit, global expansion). Also, check their past deals to confirm alignment.

- Sector Focus: Check if the VC fund is active in your niche, including DeFi, Infrastructure, Gaming, NFTs, Metaverse, Identity, Privacy, and DAOs, as most funds typically focus on a particular niche of their choice.

- Check Size and Follow-on Capacity: Verify whether the VC fund you are interested in offers micro funds ($50,000–$500,000) or large funds ($1M–$10M+). Also, check whether they have reserve capital for follow-on rounds, as this can play a major role in your system’s future.

- Equity vs. Token Terms: Verify whether the VC fund invests via equity, SAFT, or token warrants. Evaluate their vesting expectations, including cliff periods, lockups, and transfer restrictions. Investigate if the terms are founder-friendly or overly extractive.

- Geographic Focus: Check if the VC fund you are interested in is active in your region and familiar with local regulations. Also, check if they have local partners or experience working across borders before approaching them.

- Value-Add Beyond Capital: Check what additional value the VC fund offers. Do they offer hirings, exchange listings, PR, community building, and partnerships with other portfolios? Getting funds is good, but acquiring a strategic partner in the form of a VC is great.

- Reputation and Portfolio Fit: Check if the VC fund has a strong brand in your sector and if their portfolio companies are complementary or competitive. Investigate the already-funded partners if the VC is supportive or passive.

- Diligence, Speed, and Process: Check how quickly the VC conducts their due diligence. See if they require heavy documentation or if they are founder-friendly.

- Governance Alignment: Inquire if the VC fund participates in DAO governance or protocol upgrades. Ask if delegates vote or actively shape outcomes and if they are aligned with your community-first ethos.

- Lead vs. Co-Investor Role: Inquire whether the VC is willing to lead the round and set terms, or if they prefer to co-invest alongside other VCs.

Create a VC scorecard and rank funds across these dimensions. The best fit isn’t always the biggest name, but it is the one that believes in your vision, backs it with conviction, and helps you build for the long haul.

Alternatives to Venture Capital Firms for Funding

If you can’t find a VC that aligns with the vision of your project or if you find the funding terms too strict as a new founder, there are always other options that you can explore to fund your crypto/Web3 system.

1. Token Sales

You can always sell your system’s native crypto token through ICO, IDO, or IEO to raise funds. You can use crypto launchpads for this purpose.

Crypto token sales offer fast capital raise, global reach, and community building. However, they pose regulatory risk (especially in the U.S.), token dilution, price volatility, and require strong tokenomics in addition to a legal setup.

Token sales are most effective after the MVP is released, with a working product and community traction. These sales require 2–4 months prep time and need an active user base, clear utility, and a strong narrative.

2. DAO/Community Rounds

DAO/Community rounds raise funds directly from your community or DAO treasury via governance proposals or token swaps. These rounds offer aligned incentives, grassroots support, and flexible terms.

However, these rounds may result in a slow governance process and a lack of strategic guidance. They are also dependant on active DAO participation. They are best suited for protocols with existing DAOs or communities and require around 1–3 months. They require an engaged community and a robust governance framework to function effectively.

3. Ecosystem and Foundation Grants

These are non-dilutive funds from blockchain foundations such as Ethereum, Solana, or Polygon, to build on their respective stacks. They offer no equity/token dilution, technical support, and a credibility boost.

However, they are competitive and milestone-based with limited capital and are often non-recurring. They are best suited for early-stage builders integrating with specific chains and typically require around 1–2 months to complete. These grants require a clear technical roadmap and a competent development team.

4. Accelerators and Incubators

These are structured programs that offer funding, mentorship, and exposure to new cryptocurrency systems. They offer strategic guidance, network access, and exposure to Demo Day.

However, they offer small initial checks and are time-intensive. They also require equity or token allocation to provide funds and support. They are best for the pre-seed to seed stage and require around 2–3 months to complete. They require an MVP/prototype and a dedicated team to operate effectively.

5. Crowdfunding

Crowdfunding via web2 or web3 is used to raise small amounts from many backers via platforms like Kickstarter, Gitcoin, Juicebox, or Mirror. They offer community validation, flexible terms, and are great for creators/public goods.

However, crowdfunding offers limited capital and requires marketing effort. They often fail to attract strategic partners for your project. Crowdfunding is best for creative, open-source, or public-good projects and requires 1–2 months to complete. They also require strong storytelling and an engaged audience to be effective.

6. Revenue-Based Financing

It is a non-dilutive funding repaid via a share of future revenue via platforms like Pipe or Web3-native equivalents. They require no equity, scale with revenue, and are often approved real fast.

However, they require predictable cash flow and are not suitable for pre-revenue projects. They are best for post-launch projects with stable revenue and require 2–4 weeks to complete. They also require consistent revenue and financial transparency to be successful.

How Marketing and Funding Go Side-by-Side for Crypto and Web3 Businesses

In Web3, capital isn’t just fuel; it is leverage. When used strategically, funding amplifies your go-to-market (GTM) strategy, which in turn drives traction, metrics, and momentum for the next funding round.

Funding results in market activation, as fresh capital enables you to scale GTM efforts, invest in creative content, run paid campaigns, grow your community, and capture valuable data.

With marketing, you can gain fundraising momentum as marketing turns capital into users, revenue, on-chain metrics, narrative strength, and investors’ confidence.

To sync funding and marketing, you can use the following timeline.

- Announce the raise (funding) by publishing a press release and a blog post. Coordinate with investors to amplify social engagement and utilize the moment to re-engage dormant users and partners.

- Ramp GTM experiments by launching paid tests across 2–3 channels. Use A/B test messaging, landing pages, and onboarding flows to activate community incentives through airdrops, quests, and referrals.

- Track KPIs diligently by monitoring wallet growth, retention, and conversion rates. Set weekly goals for CAC, engagement, and funnel velocity to drive results. Utilize dashboards to visualize progress for both internal and external stakeholders.

- Report results to investors by sharing monthly updates that include key metrics and key learnings. Highlight wins, pivots, and upcoming milestones, and use traction to set the stage for introductions in the next round.

Marketing and funding are symbiotic levers. The best Web3 teams treat capital as a multiplier, not a crutch. Every dollar should push the flywheel forward.

Frequently Asked Questions

How do crypto venture capital firms evaluate a project?

Crypto venture capital firms evaluate projects using a mix of traditional VC criteria and Web3-specific metrics. These include team, execution ability, market opportunity, product, tech, tokenomics, incentive design, traction, metrics, governance, decentralization path, geography, and regulatory fit.

Are crypto VC investments risky?

Yes, crypto VC investments are inherently risky, and venture firms know it. But they embrace that risk because the upside can be transformative.

What’s the difference between a crypto VC firm and an accelerator?

A crypto venture capital (VC) firm primarily provides funding in exchange for equity or tokens. In contrast, a crypto accelerator is a structured program designed to help early-stage startups refine their product, pitch, and go-to-market strategy.

How much traction is “enough” to pitch?

“Enough traction” means showing real progress: a working product, growing user base, and engaged community. For pre-seed, a strong team and prototype may suffice; for seed, expect live metrics like wallet growth or TVL. Series A needs consistent usage, retention, and revenue.