NFT minting has evolved from a niche tech experiment into a powerful tool for creators and brands. In 2025, NFT minting is no longer just about turning digital files into blockchain assets; it is also about launching communities, monetizing creativity, and building decentralized brand ecosystems.

As this space matures, minting platforms have become more specialized and creator-friendly. These platforms now provide multi-chain support for broader reach, no-code tools for easy onboarding, smart contract customization for full creative control, royalty enforcement and analytics for long-term sustainability, and launchpads and marketing integrations to boost visibility.

Let’s help you find the best NFT minting platform for your needs in 2025 and launch your crypto career successfully.

What is an NFT Minting Platform?

An NFT minting platform is a digital service that enables creators to publish their digital assets, such as art, music, videos, or collectibles, onto a blockchain as non-fungible tokens (NFTs). This process is called minting, and it transforms a digital file into a unique, verifiable token that proves ownership and authenticity on the blockchain.

Minting platforms are fundamentally different from NFT marketplaces. NFT Minting platforms focus on the birth of an NFT. In comparison, an NFT Marketplaces focus on the exchange of NFTs after they’ve been minted.

| Feature | NFT Minting Platform | NFT Marketplace |

| Purpose | Create NFTs | Buy, sell, and trade NFTs |

| User Role | Primarily Creators | Both creators and collectors |

| Blockchain Interaction | Write new tokens for blockchains | Facilitate transactions of existing tokens |

| Examples | OpenSea Studio and Rarible Minting | OpenSea, Magic Eden, and Blur |

NFT Creators use minting platforms as they provide ownership and authenticity. Creators can set resale royalties to earn passive income, and limited-edition NFTs can be minted to create exclusivity. Minted NFTs can also unlock perks, access, or membership in creator-led communities.

Understanding Different NFT Minting Models

Understanding the various NFT minting models is crucial for comprehending how creators launch and distribute their digital assets. Each model offers a unique approach to timing, pricing, and audience engagement. Here is a detailed breakdown of each method.

Traditional Minting

Traditional minting is the most straightforward and widely used method for creating NFTs. It involves uploading a digital asset and immediately writing it to the blockchain, thereby making it a permanent, verifiable token.

In traditional minting, the creator uploads content, such as art, music, and video, to a minting platform. Metadata is added to the upload, including title, description, royalties, and traits. Gas fees are paid upfront by the creator to mint the NFT on the blockchain. The NFT goes live and can be listed for sale or transfer.

Traditional minting is used for art drops, one-of-one pieces, pre-sale campaigns, and collector’s items. It provides immediate ownership as the NFT is present on-chain from the start. Buyers can verify authenticity and metadata, and creators set all parameters before launch. It works across most marketplaces and wallets.

However, creators must pay gas fees even if the NFT doesn’t sell. Minted NFTs may sit idle if demand is low, and once minted, metadata is often immutable.

Lazy Minting

Lazy minting is a cost-efficient NFT creation model in which the actual minting (writing to the blockchain) occurs only when someone buys the NFT. This shifts the gas fee burden from the creator to the buyer, making it a popular choice for emerging artists and experimental projects.

In lazy minting, the creator uploads the digital asset and metadata to a minting platform. The NFT is listed for sale but has not yet been minted on the blockchain. When a buyer purchases an NFT, it is minted in real time, and the buyer pays the gas fee. The NFT is then transferred to the buyer’s wallet as a fully minted token.

Lazy minting is ideal for low-budget creators who want to test demand, for large-scale collections, and for platforms that actually support it. It has no upfront gas fees, allowing risk-free publishing, and is fast, easy, and scalable.

However, lazy minting delays minting and can create trust issues. It also has limited customization and platform dependency, as not all marketplaces support lazy minting.

Free Mint or Airdrop Models

Free minting and airdrops are promotional NFT distribution strategies that allow users to receive NFTs at no cost, either by minting them for free or having them sent directly to their wallets. These models are often used to build hype, reward communities, or kickstart engagement.

They are used for community building to reward loyal fans. They can also be used for marketing campaigns, cross-project promotions, and gamification. Free mint or airdrops cost users nothing and can lead to rapid project expansion. They also create goodwill and provide the potential to go viral.

However, these models don’t generate any revenue upfront and can attract flippers. Too many free NFTs can dilute perceived scarcity, and airdrops can be expensive for creators when done on a large scale.

Whitelist or Presale Minting

Whitelist minting, also known as presale minting, is a controlled NFT distribution model where only approved users on a “whitelist” can mint NFTs before the public sale begins. This model is designed to reward early supporters, prevent gas wars, and build community trust.

For whitelist minting to work, the project announces the whitelist criteria, and users apply to earn a spot. Whitelisted wallets are then added to a smart contract. During the presale window, only these wallets will be able to mint NFTs.

Whitelist minting is utilized for high-demand NFTs, community-driven projects, exclusive launches, and strategic collaborations. This offers fair access, encourages community engagement, provides controlled rollout, and generates early revenue.

However, whitelist minting creates barriers to entry for new users and can result in whitelist farming. It also requires a complex setup and offers limited reach as compared to other minting processes.

Dutch Auction Minting

Dutch auction minting is a dynamic pricing model where the price of an NFT starts high and gradually decreases over time until it is purchased. This approach creates a game-like tension between buyers who want to wait for a lower price and those who fear missing out.

For Dutch auction minting to work, the initial price is set, usually higher than market expectations. The prices drop at regular intervals, and buyers can mint at any point, locking in the current price. The auction ends when either all NFTs are sold, the floor price is reached, or the time limit expires. Smart contracts automate pricing and minting, ensuring transparency and fairness.

Dutch auction minting is used in high-demand projects to prevent gas wars, facilitate price discovery by allowing the market to determine fair value, ensure fair distribution, and support gamified launches.

It results in market-driven pricing, no gas wars, fair access, and transparency. However, Dutch auction minting is complex, subject to timing pressure, and may result in users paying more.

Bonding Curve Minting

Bonding curve minting is a dynamic pricing model where the cost to mint an NFT increases or decreases based on the number of NFTs already minted. The price follows a mathematical curve, often exponential or logarithmic, designed to reflect demand and incentivize early participation.

For the bonding curve minting to work, a smart contract defines the curve. The first NFTs are cheapest, and each subsequent mint costs slightly more. Buyers can mint NFTs directly from the contract at the current curve-based price. However, the curve can also be designed to decrease over time, though this is less common.

Bonding curve minting is used for tokenized art/music projects, DeFi-integrated NFTs, experimental launches, and community-driven economies. It incentivizes early buyers, reflects the market’s demand, and creates a sense of scarcity.

However, the bonding curve minting process is complex and could attract flippers. Late buyers may feel priced out or regret their purchases, and strong market demand is required for them to be effective.

Randomized or Reveal-Based Minting

Randomized or reveal-based minting is a popular NFT model where buyers mint tokens without knowing their exact traits or rarity until a later reveal. This adds suspense, gamification, and fairness to the minting experience, especially in large generative collections.

For reveal-based minting to work, buyers mint NFTs without knowing the details, and they receive a placeholder image or metadata in return. All NFTs are temporarily hidden behind generic visuals, and after the minting window closes or a set time passes, the project “reveals” the actual traits and rarity of each NFT. This reveal is often randomized via smart contracts to ensure fairness and prevent insider minting.

This method of NFT minting is used for generative art collections, hype-driven launches, fair distribution, gaming, and collectibles. Reveal-based minting creates excitement and suspense. It is also fair, provides amplified experience, and is scalable.

However, reveal-based minting can create uncertainty and speculation. If not managed well, delays can frustrate buyers, and it requires secure smart contract logic to ensure true randomness.

Top 12 NFT Minting Platforms in 2025

As the NFT ecosystem continues to evolve, creators require platforms that offer more than just minting. They need flexibility, scalability, community tools, and the ability to customize smart contracts. Here is a curated list of the Top 12 NFT Minting Platforms in 2025, spotlighting the most innovative and creator-friendly tools in the space.

| Platform | Best For | Supported Chains | Minting Cost | Strengths |

| OpenSea | First-time creators, casual artists, and large-scale generative collections | Ethereum, Polygon, Solana, Arbitrum, Optimism, Avalanche, BNB Chain, Latyn, and many more | 2.5% service fee and 10% royalty fee | Massive user base, intuitive interface, strong brand recognition, versatile tools, and integration with major wallets |

| Rarible | Creators, artists, photographers, and Web3 builders | Ethereum, Polygon, Flow, Tezos, and ImmutableX | Free/1% sale fee | Multi-chain minting, strong community governance, easy royalty setup, and an aggregated marketplace |

| Mintable | First-time NFT creators, artists, photographers, small brands, and educators | Ethereum, ImmutableX, and Zilliqa | 2.5% platform fee | True free minting, educational resources, and free listing options |

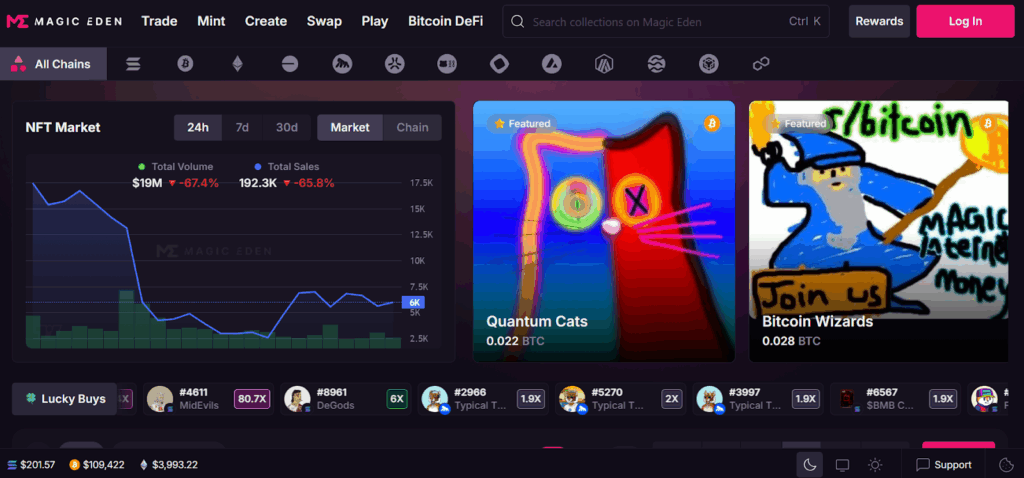

| Magic Eden | Creators, artists, and Web3 brands | Solana, Ethereum, Bitcoin Ordinals, and Polygon | <$0.01 per NFT and 2% on secondary sales | Industry-leading Solana marketplace, fast transaction speeds, low fees, strong analytics, and rarity tools |

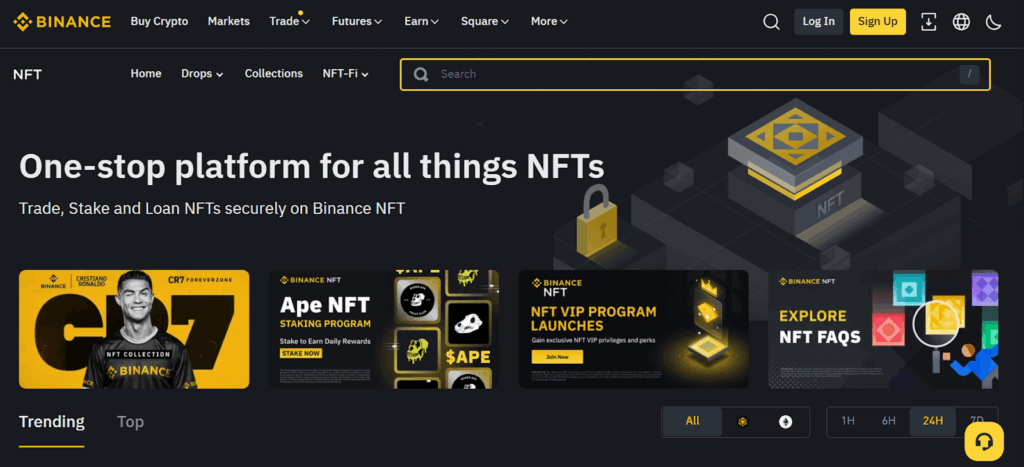

| Binance NFT | Web3 brands, investors, and creators | Binance Chain, Ethereum, Polygon, and Bitcoin Ordinals | 1% on secondary sales and varies by collection for the minting fee | Unmatched user base, fiat-friendly onboarding, and strong infrastructure |

| Foundation | Artists, creators, collectors, and Web3-native galleries | Ethereum | 5% on primary sales and royalties for secondary sales | Creator-owned contracts, an elegant marketplace, and strong creator tools |

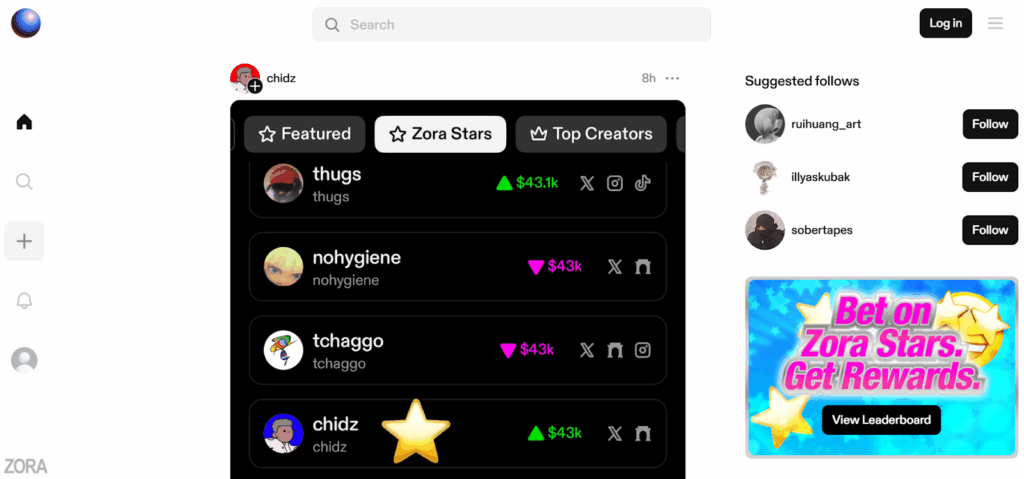

| Zora | Web3-native creators, artists, brands, and collectors | Ethereum, Zora Network, and Optimism | Free/Gas costs only | Creator-owned contracts, on-chain minting, no platform fees, and developer-friendly tools |

| Solanart | Independent artists, creators, and art-focused projects | Solana | <$0.01 per NFT and 3% on secondary sales | Reliable/fast minting, curated marketplace, and strong support for royalties |

| Super Rare | Professional digital artists, collectors, curators, and galleries | Ethereum | 15% on primary sales and gas fees for creators | Strong brand, collector trust, DAO-driven curation, and high visibility |

| Nifty Gateway | Established artists, creators, and collectors | Ethereum and Nifty Gateway’s custodial layer | 5% on primary sales and 2.5% on secondary sales | Fiat-friendly, curated drops, custodial wallets, and strong promotional support |

| Objkt | Digital artists, generative creators, and high-end collectors | Tezos | <$0.01 per NFT and 2.5% on secondary sales | Tezos marketplace, low cost, energy efficient, and vibrant community |

| Known Origin | Professional digital artists, photographers, collectors, and curators | Ethereum | 15% primary sales | KO studio, curated platform, modular minting support, and strong brand backing |

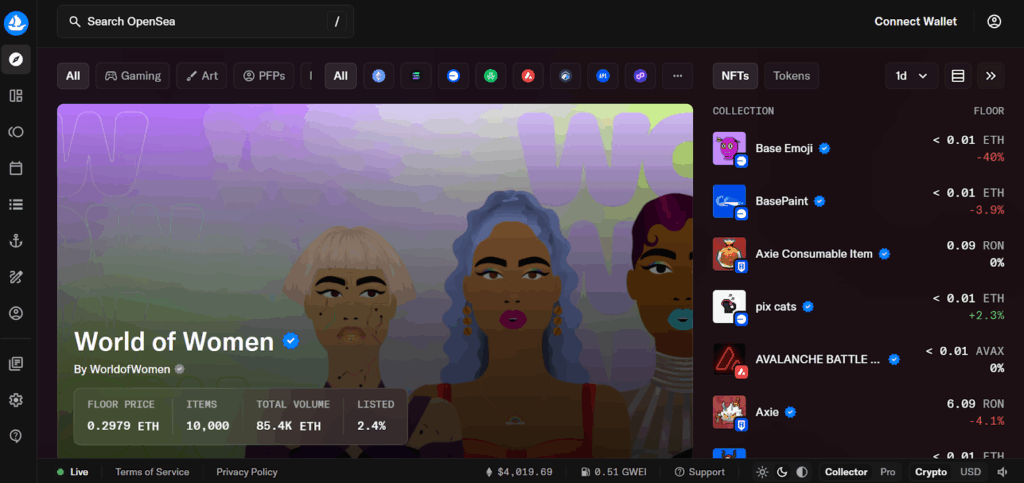

1. OpenSea

OpenSea remains the largest and most accessible NFT platform in 2025, offering creators and collectors a robust suite of tools for minting, buying, and selling NFTs across multiple blockchains.

It was founded in 2017 by Devin Finzer & Alex Atallah and has over 1.9 million active users. It has over 80 million NFTs listed across various categories and supports both traditional and lazy minting.

OpenSea offers seamless listing and trading after minting, supporting wallets such as MetaMask, Coinbase Wallet, and WalletConnect. You can use ETH, WETH, USDC, DAI, SOL, and other cryptocurrencies for payments on it. It doesn’t support fiat directly, but MoonPay integration is available.

Pros

- Easy onboarding for creators

- Lazy minting available

- Largest NFT collection globally

- Supports multiple media types, such as art, music, domains, and gaming assets

- Competitive 2.5% service fee

- Active secondary market with high visibility

Cons

- 10% royalty cap for creators

- Limited customer support

- Occasional issues with fake or plagiarized NFTs

- No direct fiat payments

- Centralized moderation has faced criticism

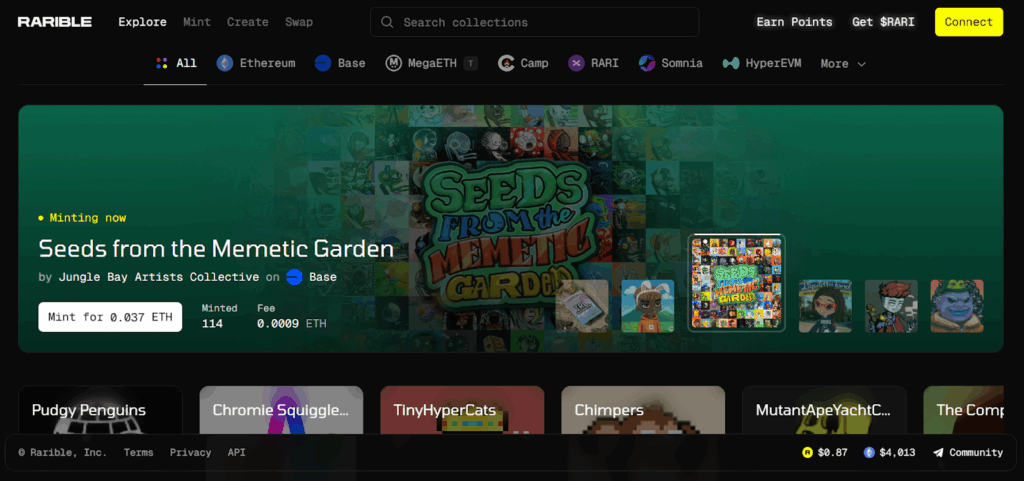

2. Rarible

Found in 2020, Rarible is a decentralized NFT marketplace and minting platform that empowers creators with multi-chain support, customizable royalties, and community-driven governance.

Rarible offers no-code minting with royalty setup and multi-chain support. It is powered by the $RARI token and the Rarible DAO, which aggregates listings from OpenSea, LooksRare, and other platforms. It also offers custom storefronts, analytics, and lazy minting options.

Pros

- Rarible supports multiple blockchains.

- It also offers lazy minting with no upfront gas fees.

- Creator royalties on Rarible are customizable.

- DAO governance gives users voting power.

- It has a clean and beginner-friendly interface.

- Aggregated listings on Rarible increase visibility.

Cons

- Rarible has less traffic than OpenSea or Magic Eden.

- Royalty enforcement depends on the buyer’s platform.

- Rarible provides limited smart contract customization compared to Manifold.

- Some features are gated behind the use of the $RARI token.

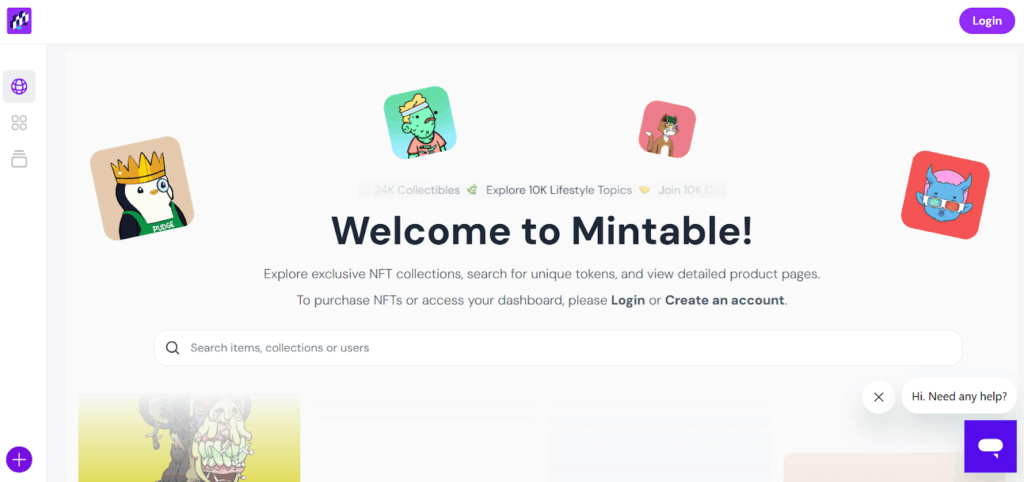

3. Mintable

Founded in 2018, Mintable is a user-friendly NFT platform designed to make minting simple and affordable for creators of all levels. It offers a free minting tier with no upfront gas fees. Mintable also features both curated and open listings, offering no-code minting and drag-and-drop media upload. It supports MetaMask and WalletConnect, and provides built-in guides and tutorials for new users.

Pros

- Free minting (lazy minting) is available on Mintable.

- It offers a beginner-friendly interface with step-by-step guidance.

- No coding or blockchain knowledge required for minting on Mintable.

- Mintable supports multiple media formats, such as images, audio, and video.

- It also offers both gasless and traditional minting options.

Cons

- Mintable has limited customization for smart contracts.

- It has a smaller user base compared to OpenSea or Magic Eden

- Royalty enforcement may vary across platforms.

- Mintable has fewer advanced features for developers or large-scale projects.

4. Magic Eden

Founded in 2021, Magic Eden has emerged as one of the most influential NFT platforms in 2025, particularly for creators and brands building on the Solana blockchain. Known for its fast minting, curated launchpad, and vibrant community, it is a go-to destination for gaming assets, collectibles, and mobile-first drops.

Pros

- Magic Eden offers fast and low-cost minting on the Solana blockchain.

- It offers curated launchpad boosts visibility for new projects.

- Magic Eden boasts strong community engagement and a mobile-first user experience.

- It has built-in rarity rankings and analytics for collectors.

- Magic Eden provides expanding support for Ethereum and Bitcoin Ordinals.

Cons

- Launchpad access is selective on Magic Eden.

- It also has limited smart contract customization compared to Manifold or Zora.

- Royalty enforcement varies across chains.

- Magic Eden has a smaller reach outside the Solana ecosystem.

5. Binance NFT

Launched in 2021, Binance NFT is the minting and marketplace arm of Binance, the world’s largest cryptocurrency exchange. It combines NFT creation with deep liquidity, user trust, and cross-platform exposure. This makes it a strategic choice for brands, investors, and creators seeking to scale.

Pros

- Binance NFT offers a massive global reach via the Binance exchange.

- It also offers easy onboarding for users with Binance accounts.

- Supports fiat and crypto payments.

- Binance NFT’s launchpad offers curated exposure for select drops.

- It offers a strong security and compliance infrastructure.

Cons

- Minting access is limited and requires an application or approval.

- Binance NFT is less flexible than creator-owned platforms like Manifold or Zora.

- It also has fewer customization options for smart contracts.

- Royalty enforcement depends on platform policies.

6. Foundation

Launched in 2021, Foundation is a creator-focused NFT platform known for its elegant design, curated community, and emphasis on high-quality digital art. It is built to empower artists with on-chain minting, collector tools, and a refined marketplace experience.

Pros

- Foundation offers full control over smart contracts and metadata.

- It has a clean and art-forward interface that appeals to collectors.

- Foundation offers timed auctions and reserve pricing for premium drops.

- It also has a strong community of digital artists and curators.

- Foundation has a built-in royalty enforcement and creator attribution.

Cons

- Foundation requires Ethereum gas fees for minting.

- Not ideal for large generative collections or gaming NFTs.

- It has a limited multi-chain support.

- The Foundation has a smaller audience than OpenSea or Magic Eden.

7. Zora

Founded in 2020, Zora is a decentralized NFT protocol and marketplace that empowers creators. Built for Web3-native artists, brands, and developers, Zora emphasizes on-chain minting, creator-owned smart contracts, and community-first tools, which make it a standout choice for those who value autonomy and transparency.

Pros

- Zora offers full creator ownership of smart contracts.

- It features on-chain minting, ensuring transparency and permanence.

- Zero platform fees on Zora Network.

- Zora has built-in auction formats and reserve pricing.

- Strong community and open-source ethos form the core of Zora.

Cons

- Requires Ethereum gas fees unless using the Zora Network.

- Zora is less beginner-friendly than platforms like OpenSea or Mintable.

- It offers limited support for lazy minting.

- Zora has a smaller audience compared to mainstream marketplaces.

8. Solanart

Launched in 2021, Solanart was one of the first NFT marketplaces built on the Solana blockchain, providing creators with a fast and low-cost way to mint and sell digital assets. While newer platforms like Magic Eden have gained more traction, Solanart remains a trusted option for curated collections and independent artists.

Pros

- Solanart offers low transaction fees thanks to Solana’s speed and scalability.

- It has an easy onboarding process for creators with no coding required.

- Royalties are supported and enforced on secondary sales.

- Curated collections help maintain quality and trust.

- Solanart offers a fast minting and listing process.

Cons

- Solanart has a smaller user base compared to Magic Eden.

- It has limited marketing and launchpad support.

- Less visibility for non-curated or indie projects.

- Fewer advanced features for developers.

9. SuperRare

Launched in 2018, SuperRare is a high-end NFT marketplace focused exclusively on single-edition digital artworks. It’s built for serious artists and collectors who value curation, provenance, and artistic integrity. With its sleek interface and strong community, SuperRare has emerged as a cultural hub for crypto art in 2025.

Pros

- Superrare has an exclusive focus on 1/1 art enhances prestige and scarcity.

- It only offers verified artist profiles that build trust and authenticity.

- Strong collector base for premium digital art.

- DAO governance on Superrare allows community curation and voting.

- Built-in royalties and auction mechanics.

Cons

- Superrare requires application and approval to mint.

- It only supports single-edition NFTs.

- Ethereum gas fees apply for minting.

- Not ideal for casual creators or mass-market drops.

10. Nifty Gateway

Launched in 2020, Nifty Gateway is a curated NFT platform known for hosting high-profile drops from renowned artists, brands, and celebrities. Backed by Gemini, it offers a seamless experience for both crypto-native and mainstream users, with credit card support and custodial wallets.

Pros

- Nifty Gateway accepts credit cards and fiat payments.

- It also offers curated drops that attract high-profile collectors.

- Custodial wallets simplify onboarding for non-crypto users.

- Strong brand partnerships and celebrity collaborations.

- It has built-in royalty enforcement and drop analytics.

Cons

- Minting access is selective and requires approval or partnership.

- Limited smart contract customization.

- The custodial model means users don’t hold private keys unless withdrawn.

- Higher platform fees than decentralized alternatives.

11. Objkt

Launched in 2021, Objkt is the leading NFT marketplace on the Tezos blockchain, known for its low fees, energy efficiency, and strong support for generative and digital art. It’s a favorite among artists and collectors who value sustainability, affordability, and creative freedom.

Pros

- Objkt offers extremely low minting and transaction fees.

- Eco-friendly blockchain with minimal energy consumption.

- It also supports multi-edition and generative art drops.

- Aggregated marketplace boosts visibility.

- Objkt has a strong community of digital artists and collectors.

Cons

- Objkt is limited to Tezos with no Ethereum or Solana support.

- Smaller audience compared to OpenSea or Magic Eden.

- Objkt has fewer advanced smart contract features.

- Not ideal for large-scale brand campaigns or gaming NFTs.

12. KnownOrigin

Launched in 2018, KnownOrigin is a highly curated NFT platform that empowers digital artists through smart contract ownership, creative control, and community engagement. Acquired by eBay in 2022, it blends artistic integrity with scalable infrastructure, making it a standout choice for serious creators in 2025.

Pros

- KnownOrigin offers full smart contract ownership via KO Studio.

- Curated onboarding ensures high-quality collections.

- It also offers modular minting tools for editions, collaborations, and dynamic NFTs.

- Strong community of artists and collectors.

- Backed by eBay for infrastructure and reach.

Cons

- On KnownOrigin, applications are required for creator access.

- Ethereum gas fees apply for minting.

- It is not ideal for large generative or gaming projects.

- Smaller audience compared to OpenSea or Magic Eden.

Solana NFT Minting Platforms: Why They Stand Out

Solana has carved out a powerful niche in the NFT ecosystem by offering fast, low-cost, and scalable minting, making it a favorite among creators and collectors looking to avoid Ethereum’s congestion and high gas fees.

Solana can handle thousands of transactions per second and is ideal for large-scale drops. Minting an NFT on Solana typically costs a fraction of a cent, and the transactions settle in seconds, providing a smoother minting experience. Tools like Metaplex on Solana simplify the creation of smart contracts and the management of metadata.

Solana’s architecture makes it especially attractive for gaming NFTs, generative art, and community-driven collections. Key Solana minting platforms include Magic Eden and Metaplex.

Magic Eden: It is Solana’s leading NFT marketplace and minting platform, featuring a launchpad for curated drops, support for whitelists and public minting, and built-in analytics and rarity tools. Magic Eden offers a massive community reach, fast minting, and robust secondary market liquidity.

Metaplex is the backbone of Solana NFT infrastructure, featuring Candy Machine v3 for generative drops, custom smart contracts, and royalty enforcement tools. It offers complete developer control, scalability, and modular design.

While both Solana and Ethereum offer NFT minting, they differ significantly in their ideologies and how they treat their users.

| Feature | Solana | Ethereum |

| Transaction Speed | 400ms | 15s |

| Minting Cost | <$0.01 | $5–$50+ (depending on gas) |

| Scalability | High | Moderate |

| Security | Growing Ecosystem | Mature and Battle-Tested |

| Developer Tools | Metaplex, Anchor | Hardhat, OpenZeppelin |

| Marketplaces | Magic Eden, Tensor | OpenSea, Rarible, Zora |

Creators choose Solana because it is cost-effective for large drops, ideal for gamified and interactive NFTs, offers a strong community, provides robust tooling, enables rapid experimentation, and facilitates quick iteration.

Free vs Paid NFT Minting Platforms

When launching NFTs, you will face a choice between free minting platforms (typically lazy minting) and paid minting platforms (traditional minting with upfront gas fees). Each model offers distinct advantages depending on your goals, budget, and audience. The key differences include.

| Feature | Free Minting (Lazy Minting) | Paid Minting (Traditional Minting) |

| Cost to Creator | $0 upfront (buyer pays gas) | Creator pays gas fees upfront |

| When Minting Happens | At the time of purchase | Immediately upon creation |

| Blockchain Load | Lower (minting is staggered) | Higher (bulk minting can spike gas) |

| Ownership Timing | NFT exists only after purchase | NFT exists before the sale |

| Risk Level | Low (no sunk cost if unsold) | High (creator pays even if the NFT doesn’t sell) |

| Trust and Transparency | Lower (NFT not visible on-chain until sold) | Higher (NFT is verifiable from the start) |

Free minting has no upfront cost for creators, helps test demand, provides easy onboarding for beginners, and scales to large collections. However, in free minting, NFTs don’t exist until sold. It may reduce buyer trust, offer limited smart contract customization options, and be platform-dependent. Some examples include OpenSea, Rarible, and Mintable.

In paid minting, NFTs are immediately live and verifiable. It offers full metadata control and customization and is compatible with all marketplaces. Paid minting is better suited for high-value or rare items, and some examples include Manifold, Zora, and Foundation. However, it requires upfront gas fees, poses a risk of unsold inventory, and is not ideal for creators with limited budgets.

How to Choose the Right NFT Minting Platform for Yourself

Here’s a practical, creator-friendly NFT minting platform checklist to help you choose the right platform based on your goals, budget, preferred blockchain, and audience reach.

- Define your goals clearly. Are you launching a one-of-one art piece or trying to build a community?

- Assess your budget and check if you can afford upfront gas fees.

- Carefully choose your blockchain and decide whether you want a multi-chain solution or not.

- Consider your audience’s reach and determine which platform they are most active on.

- Evaluate the platform’s features to determine if they meet your needs.

- Evaluate trust and security by checking if the platform is well-established and if your NFTs are interoperable across marketplaces.

- Start with platforms like OpenSea or Magic Eden for ease and reach, then explore Manifold, Zora, or Foundation if you need advanced control and customization.

How NFT Minting and Marketing Work Together

In the world of NFTs, minting creates the product, but marketing drives its value, visibility, and community adoption. Here is how the two work together and how Web3 brands can harness their synergy.

Minting is the technical process of turning a digital asset into a blockchain-verified token. It is essential, but it doesn’t guarantee success. Without marketing, even the most brilliant NFT can go unnoticed.

- Minting = Creation

- Marketing = Connection

Marketing amplifies NFT success through storytelling and branding, as NFTs with compelling narratives attract greater interest. It fosters community, as Discord, Telegram, and Twitter are integral to NFT culture.

Marketing also helps NFT projects partner with artists, streamers, or crypto influencers to boost visibility. It provides launch strategies for timed drops, whitelist access, and reveal-based minting to build anticipation and excitement.

As NFTs are tied to perks, they need clear messaging. Marketing educates users on how to unlock their value beyond the token.

Web3 brands and businesses can leverage this synergy for fashion and luxury by utilizing NFTs for digital wearables, loyalty programs, and exclusive drops. For gaming, the in-game assets can be marketed as tradable NFTs with real-world value.

In the music and entertainment industry, businesses can offer backstage passes, unreleased tracks, or fan voting rights via NFTs. For educational purposes, NFTs can be used to provide token-gated access to courses, webinars, or in-person meetups.

Successful NFT projects treat minting as the launchpad, not the finish line. They know that marketing fuels this journey by building hype, trust, and long-term engagement.

Frequently Asked Questions

Why isn’t my NFT collection selling even after minting?

If your NFT collection isn’t selling even after minting, it’s likely because minting is only one piece of the puzzle. The reasons can include a lack of marketing, poor visibility, inadequate community engagement, a high price, unclear utility, a suboptimal platform choice, or weak branding.

Which minting platforms are most beginner-friendly?

The most beginner-friendly NFT platforms in 2025 include OpenSea Studio, Rarible, Mintable, Magic Eden, and Zora.

Can I switch platforms after minting NFTs?

Yes, you can switch platforms after minting NFTs, but with a few important caveats. You can list your NFT on multiple marketplaces, transfer your NFT to another wallet, use third-party tools, and bridge your assets. However, you can’t remint the same NFT on another blockchain, change the original metadata, smart contract, or move an NFT from Ethereum to Solana directly.

Do all platforms require a royalty setup?

No, not all NFT platforms require a royalty setup, but most offer it as an optional feature, and some strongly encourage it to support creators.

Can minting platforms help with NFT marketing directly?

Yes. While minting platforms primarily focus on the technical side of creating and launching NFTs, many now offer built-in promotional tools, launchpads, and community features to help creators gain visibility.